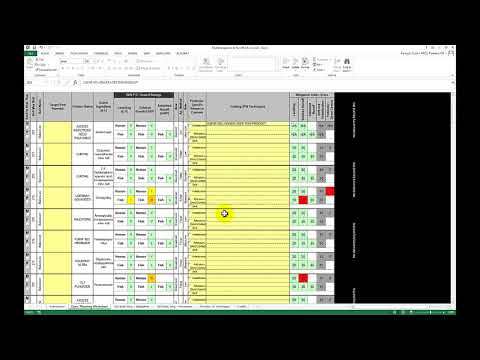

Welcome everyone to this training. Well, I will discuss how to fill out the 595 implementation requirement from the information that was exported in when PST. We begin with the pest management and 595 implementation requirement Excel spreadsheet. In this case, I'm working with version 3.4 that was released in December of 2016. In all the versions that have been released, there's always an instruction tab. So, if you click on the bottom left-hand corner, the first tab, in all these workbooks that have gone out before, there is a step-by-step instruction. I strongly recommend that you print these out. These are not meant to be viewed on the screen; it's meant to be printed out. Then, you can follow the instructions on how to fill out the worksheet and then how to fill out the implementation requirements, whether it's mitigation or prevention. To begin with, ensure that your computer security allows for macros to be run. We can see that's step one - enabling macros. Once that's done, then these macros will work. We start with getting the wind PST data. Here is the file that I saved in the last video. So, we select that, and we click open. If you'll notice, these cells here have now been populated, and the table below is populated with the wind PST data. All the yellow cells in the spreadsheet are to be filled out by the user. So, we begin top left and work our way down. Once we have the general information filled out, we look at the pesticide-related resource concerns that you are using this standard to address or this worksheet to address. If you're concerned potentially concerned about pesticides leaching to groundwater for human consumption, then you would click that. If, on the other hand, you're concerned...

Award-winning PDF software

Irs ein Form: What You Should Know

Do this prior to the effective date of the change. Use Form SS-4 to apply for an Employer Identification Number (EIN). A new EIN may be required to: (1) be added to a previously issued EIN; or (2) be issued for a new entity to be created. For more information about an amended or revoked EIN, refer to Form SS 4, Notice of Adjustment to an Employer Identification Number. Application (with a new EIN) or amendment (and a new EIN issued by the IRS) — IRS A single EIN may be applied to multiple entities. To apply for multiple Wins, each applicant must be a responsible individual with a valid Taxpayer Identification Number (SSN, ITIN, EIN). The responsible person must answer questions about the new EIN, the entity's name, the intended purpose of the EIN(s) and the filing status. Applications (including multiple Forms SS-4) should be filed (with a newly issued EIN) by mail, fax, by email, or in person at the address of the principal business address (see EIN Authorization). Apply and authorize application (with a new EIN) or amendment (and a new EIN issued by the IRS) online — IRS Complete this section only if you want to authorize the named individual to receive the entity's EIN. You may not authorize the named individual (or others associated with the business) to receive more than 1 EIN. You cannot authorize the names of others for their own entities, unless all of those entities are owned by the same responsible individual with a valid SSN, ITIN and the correct filing status. Note : If only the name change or amendment of an EIN is authorized, the name change must be filed through IRS Form SS-4 or an IRS Forms 1099-K, or an IRS Form 1099-P or a Form W-2. If you are an authorized user (or other responsible organization), you may: Filing and reporting — IRS Complete the required section only if you are requesting a new EIN with a new filing status. For more information about filing and reporting, see Filing a New Tax Return. Application (with a new EIN) or amendment (and a new EIN issued by the IRS) — IRS Complete this section if you want the named individual to receive the EIN.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Publication 1635, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Publication 1635 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Publication 1635 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Publication 1635 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs ein